Because the ‘numbers’ that neoliberals have decided are the indicators of a “good” economy mean almost nothing to, in all likely hood, 95% of Americans.

Measuring the right thing leads to inconvenient conclusions (age till retirement, income at retirement, income independence, buying power, home ownership, business ownership, union membership, etc.)

Bloody well hate the neoliberals. One was arguing with me on reddit that because people in Kenya are better off, compared to the 80s, I should stop complaining.

Like ok I am happy for the people of Kenya. I got nothing against them. So yeah good job. Now can my healthcare costs please go down? Because I am pretty confident that they can and the people of Kenya can also be doing well. One really doesn’t impact the other that much.

No, you see, because TVs have gotten consistently cheaper (they’re like the only thing to have done so), everything’s working!

And the main reason they’re cheaper is because all of them are data harvesting machines. What a fun world where even your habits are a commodity!

Like they even give a shit about Kenya. Just blatant manipulation.

Fuck neoliberalism. Glad I found out what it was. It really highlights everything that is wrong with the American economy.

I feel like I have been seeing the same article once a month since 2007.

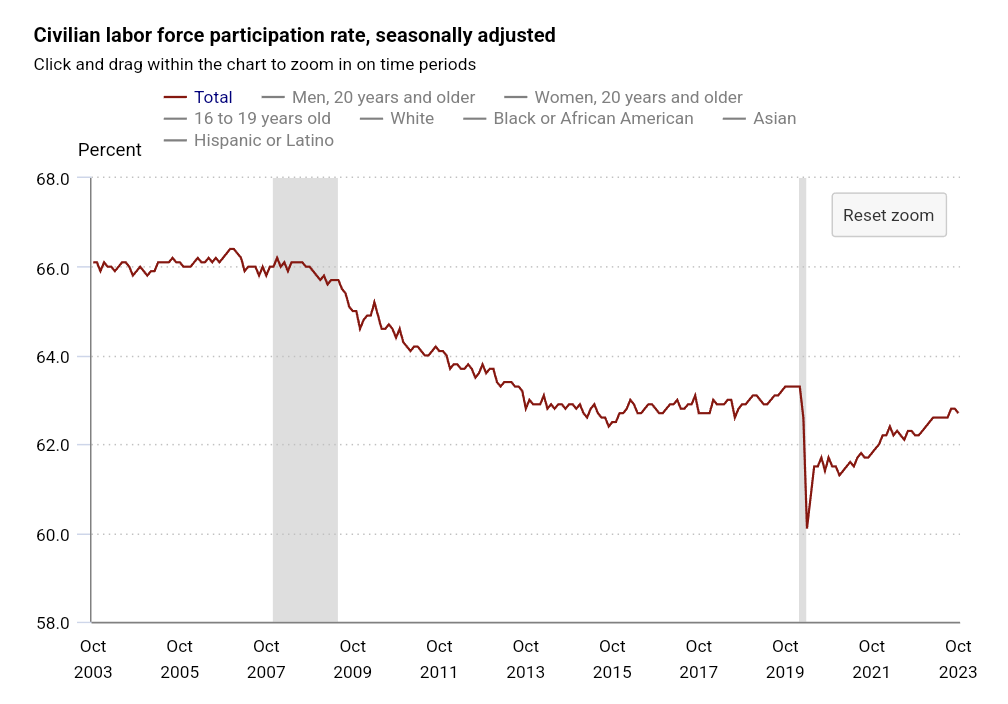

A. Unemployment numbers are basically a lie at this point. The only number that comes even close to representating the situation is the workforce participation rate. Question: what percent of people are employed? Answer: what percent of people are employed. It is simple as that. If you look at pretty much every month the US hits a new low. Over a third of the adult population did not earn $20 dollars last week. There was a slight trending down right before 2007 crash but not significant. A deep dive into the numbers shows that this is not the result of retirement, it is the result of prime working age males dropping out.

B. Who cares if inflation is low at this moment? That is like arguing that everything is fine the previous 5 minutes when a car crash happened 6 minutes ago.

Peices of garbage keep telling us that everything is fine when it fucking isnt

I really like that car crash analogy or whatever you want to call it. It isn’t like sudden positive changes in inflation or job numbers magically fixes QOL for people overnight. It can take weeks…months, maybe even years (maybe even never?)

This is it exactly. Positive changes in inflation mean prices aren’t going up as fast. They’re still going up. They’re never going to go down because businesses don’t charge less when the alternative is making more money. They only ever charge more with inflation.

Checks out. Not a huge change but a definite trend.

Source: https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

Corporate profits ≠ my wallet

Corporate profits <- your wallet

Because it’s a bullshit narrative. Cost of living keeps going up. But inflation doesn’t count rent, groceries, or gas.

For what it’s worth gas has come down quite a bit the last few weeks.

deleted by creator

Rent is going to go up as long as it’s able.

As soon as people have more money to spend, landlords increase rent.

Renting is one of the biggest scams this generation has convinced itself into falling for.

I wasn’t able to afford to buy a house until I was over 50 years old, it took a global pandemic, a complete shutdown of the economy, and working from home for multiple years to bank the cash to make it happen.

People don’t rent because they CHOOSE to.

How much was your house?

Listed for $374,000, but I had to bid up to $390,000 to get it.

Yeah, you didn’t have to spend anywhere near that much.

But you wanted to, so you did.

This generation? Fucking Romans were complaining about high rent for shitty apartments over 2000 years ago. Don’t be a dumbass.

Right… and no generation since has ever seen the value of owning property, right? Lol.

Mark Twain was right. It’s easier to fool someone than to convince them they’d been fooled.

See how mad people get in this comment section when someone points out they’re being taken for a ride? One person even said they won’t get off the ride if it isn’t “easy.” Lol.

Supply and demand. You’re not exempt from them.

slaps forehead wait I can just buy a house? What a solution!! So easy!

You are being sarcastic but a lot of people who are convinced they can’t afford it actually could afford to own the place they rent and have just never crunched the numbers.

Before the rate hike this was probably true, but most areas haven’t adjusted to people having about 100k less buying power.

I never said it would be easy.

Do you only do things if they are easy?

I make about $75k a year, but to afford a $700k house (which is a “reasonable” price) near my city (Seattle), I’d have to make $150k per year. The only affordable houses are two hours’ drive away, and there are no “starter” homes to buy. I can skrimp and save for the rest of my life (and I am). But unless I get a huge raise (and I’m already above the median national income), buying a house is impossible. Not just hard, economically impossible.

I’m also in Seattle and it’s bad out here. I was looking at townhouses last year before the rates went up but couldn’t get a mortgage because of a limited amount of work experience since getting my second degree during the pandemic. I was actually surprised that I could have afforded a decent townhouse in like Edmonds or Shoreline until the rates shot up - going from 3.5% to 7% adds something like $1000 a month in interest on a $400k mortgage. Then I realized I have never lived alone before and wasn’t sure if buying a place was the best way to try that out lol. Average rent in Seattle right now though is like $2300-$2400 a month which is close to 50% of the take-home income of someone making $100,000 per year. It’s insane.

Because those two metrics are meaningless for the average person.

Inflation is trending down… After it skyrocketed and is still way above affordable ranges.

Employment rates are high… But those jobs don’t pay living wages.

Go check how much savings the average American has, check what an average doctor’s visit costs, and then maybe you’ll understand the gloom.

Median figures are more accurate and scarier than average.

Because interest rates are insane trapping people in homes they no longer want but can’t afford to leave?

Speaking of… My car got totalled at the end of October, shopping for a new one, I saw interest rates for me between 7 and 8%, for other folks, I saw one as high as 12.25%(!) On a CAR LOAN.

Because interest rates are insane trapping people in homes they no longer want but can’t afford to leave?

I’m in this comment and I don’t like it.

Least you got a home. I am on a very long lease and landlord is getting offers. I got about 2.5 years until someone just offers him a million bucks in cash. Then I am out thousands of dollars in moving expense plus changing my kids school. Plan to fight it but I am sure I will lose.

Sorry bro.

Try to own property as quickly as you can. Unfortunately, even the market for that has gone to shit thanks to investment companies.

This is what we get for breeding for greed. Gotta stop rewarding shitbags just because they have money and start holding them accountable for how they got it.

It won’t happen, though, lol. These problems won’t get solved just like global warming 🤷. We don’t want to solve them.

Yeah, I’m aware it can be worse. I could go into details about how I got boned, but that’s not the point either of us were making. I have friends that rent and the only ones that didn’t get their nuts put in a vice were already under section 8. One couple just had to uproot again because the landlord sold. Again. Second time in three years. I can’t help them, and I hate it.

Interest rates should never have been that low to begin with. It was basically free money for the wealthy, and it’s how housing became such an investment for big businesses. The rates we have now are still at historic lows, they just feel high compared to the bonkers low rates of the last couple decades. I understand the frustration 100%, but lowering the rates again is NOT the answer at all.

For Christmas dinner I vote we just eat the fucking rich

“Why Americans feel gloomy about the economy despite paying a lot more for things than the official inflation numbers claim and having a wage that isn’t rising as high as official numbers claim”

Not to leave out unemployment has run out for thousands, making the numbers look good.

Exactly. When my benefits ran out 2 months ago, I no longer showed up as unemployed. Thankfully, I finally got a job after nine months of anxiety.

While I have a better income than before, it’s only about 10%, while prices on everything (that i need for daily survival) went up at least 20%, and food nearly doubled. No way I can get a house - those prices went up at least 40% here in the last 4 years. New car? Fuggettaboutit. Basic sedans going for 30k! Used ones probably for $24k, from what I read. Since when does COBRA at $1900 per month for one person make sense? It’s a slap in the face.

Didn’t the student loan moratorium also end? Something started back, maybe evictions too. None of it is good.

“falling inflation” means prices are still rising…the rate of increase is what has decreased. What we need is negative inflation…or said differently, price decrease.

You don’t actually want that. It encourages people to “invest” by sticking hard cash in a mattress. It rewards people for doing absolutely nothing but taking money out of the economy.

Ideal (if we’re keeping a monetary exchange society, anyway) is low (<3%), predictable inflation combined with wages increasing in proportion to productivity. We had a period of relatively low inflation followed by a giant spike, plus wage gains that are nowhere near matching productivity gains over the last 50 years, and that’s where things hurt. Capitalism doesn’t seem capable of this, however, as it’s always chasing the next hype cycle that leads to these spikes and lulls.

As opposed to what we have going on right now, which is to punish working class people so ruling class people can still have prosperity.

What you are describing is deflation and it’s only happened twice during the history of the United States. It is also generally looked at as a bad thing.

Is inflation generally looked at as a good thing or a bad thing? Ive only ever heard people complain about inflation.

If they are both bad things im willing to give the bad thing that improves my life a try over the bad thing that makes everything more expensive.

Granted i have nothing so im probably on the side of things that is least effected by the bad side of deflation.

If i can spend more money on the things i want to, it will absolutely help small local businesses near me

A small amount of inflation is healthy. You REALLY want to avoid deflation, because that means the value of your money is increasing. If people know their money will be worth more in the future, they won’t spend it, incentivized to save and sit on it. That means on average everyone spends less, slowing the economy down and starting into a recession/depression.

Gonna slap this with the good old “I am not an economist” disclaimer, juat what I remember from economics class in high school

Only problem that right now people also may decide against buying because they can’t afford it. Also, I’m not sure world is producing goods at a healthy rate either, more like we’ve got a bit of an overproduction

What you learned in high school puts you miles ahead of 99% of these comments

Deflation means stagnation or crash in economic terms

Cool, working class people aren’t really thriving right now anyway. Maybe an economy crash could result in a restructuring of wealth and new tax policy.

Sure. I don’t believe in infinite growth either, I’m unsure however who’d come up on top. The new aristocracy?

And yet it is exactly what the people need to be happy

Meditate on that point

For every economic problem, the burden falls on the working class. Deflation makes people unhappy, high inflation makes people unhappy, and low inflation is the “best” because things get worse more slowly. Capitalism only helps workers when large enough innovations happens. Otherwise, the owners capture all the benefits of growth, or squeeze the workers to make the appearance of it.

The majority of people are in debt. If you owe $1000, you’ll still owe $1000 but $1000 will be more money than it is now.

If prices drop then you have more money to pay for that 1000 dollars is how proponents are looking at it, i assume

People have always been, in the grand sense, pretty dumb.

True

Wages need to keep up with inflation, else it’s a bubble. 😉 But we fundamentally agree

Deflation is a death spiral. China is going through it rn. The currency gets stronger, but then people wait to buy stuff like houses because it will be cheaper in a few months. It creates a snowball effect as people all start holding off on buying and selling stuff, wanting the best deal possible, or then being unable to buy things if people hold off on selling.

Maybe it’s because everyone is struggling with high costs of housing, food, and healthcare, among other things, while wages have remained flat and stagnant for decades.

I can’t remember the last time people felt good about the economy.

I can… but I was born in the 70s

I’d say it was pre-2008, but I was born in the 90s.

I really wish news outlets would stop pretending this is some big mystery. Shit is too expensive.

IMO it’s the inverse, we don’t make enough. The 1% have been keeping wages stagnant. We can’t stop the price of goods from going up, but we can increase pay from it sharing the bottom line. As soon as interest rates re-appeared, all the free money that was sitting around for the taking disappeared. Sooner than later, we’ll be paying micro-transactions for crap that was previously able to be paid for by selling us ads. But that money isn’t coming back to us.

It is difficult to get a man to understand something when his salary depends on his not understanding it.

- Upton Sinclair, 1934

Part of what’s happening on this front (things are expensive) is antitrust-related.

Mergers and Acquisitions among competing companies, and ‘vertical integration’ along supply chains (both of which ought to get a lot more antitrust attention than they have for a long time) often means the resulting companies control supply enough that they can throttle supply and look, there’s not enough of the things! Prices then go up- and the loss in productive capacity that happens when competing firms consume each other is behind those mysterious ‘supply chain issues’ that led to empty shelves during the pandemic.

The election wave immediately following Watergate swept a lot of then-young, centrist Democrats into the halls of congress- and in so doing, also retired the Democrats’ institutional interest in anti-monopoly enforcement. Since then, neglecting antitrust enforcement on boring things like commodities and pharmaceuticals has been a bipartisan affair.

“most prices are high and still rising” Pretty obvious that corporations are price gouging to get their friendly fascist lifetime dictator back in power.

My wife and I are making more money than we ever have in the past. However, before that I was unemployed and was forced to find some way to keep being able to buy groceries, gas for the car, and helping my wife pay bills. As such, the only way I saw to do so was to take out a credit card or two, and they quickly got maxed out. So now I’m stuck paying $700/month in credit card bills, as well as dealing with the increasing food and rent prices. Our bills take a larger percentage of our total wages than before. And sure, part of that’s my own fault, but at the time it was do what I did or starve and get evicted. I wasn’t about to let that happen to my wife.

We’re still able to survive, but it’s by the skin of our teeth.

I’m in a similar boat. Had to float on credit for months. When I eventually manage to get a job of means I’ll be able to start digging myself out of a hole. Forget about being ahead.

Yeah, even utility bills are through the roof. I just got my October gas bill in the new house I’m renting, $150. I’m nervous to see what that’s going to be in January, it’s already cold and the furnace has been cranking.

Dang, it must be rough living on peanut butter and jelly sandwiches.

Not quite to that degree, but not far off.

Someone feel free to explain these two simultaneous headlines-

deleted by creator

Since I’m just renting, I have more disposable income for luxury shopping.

I know no one with a lower rent than my mortgage. Literally no one.

deleted by creator

I likely do, nice to meet you.

I also don’t pay taxes, maintenance, or homeowners insurance. I only have to pay to insure my things.

You can argue those costs are baked into my $1250 rent, and you’re probably right, but I guarantee it’s less than your mortgage and associated costs would be where I live.

The Black Friday article in the picture basically explains the last part of your comment. Everyone waited for sales all year and spent now

People who feel bad buy things to feel better. They might not be able to afford a new house or a car or medical care, but they’ll spend something on gifts.

Also, maybe it’s members of the owning class buying things. They’re getting more money all the time, whether the economy does “good” or not. So they’ve always got money to blow on shit.

Plus it specifically says online sales. Online sales could be up 7.5%, but brick and mortar store sales could be down 50% for all we know.

You can buy a tv for cheaper than a loaf of bread.

Jesus, what kind of bread are you eating?

Only the best ritziest! I saved all year for it.

Sure, no problem. Spending rose by 7.5%, inflation until recent months was at 10%. Net real sales is down by 3.5%. People are spending more for less. This is why we are gloomy. Still, I recognize things are getting better on the macro level.